With increasing digitisation, cryptocurrencies are emerging as a new age asset class, providing an additional option for diligent investors.

The cryptocurrency industry has made rapid strides in a short span of time in India. With the Supreme Court lifting a ban on banks dealing with the crypto based companies, more than 10 million Indians have parked some of their investments in cryptocurrencies and have gained considerably in the last one year.

In a webinar titled New Age Gold organised by Giottus Cryptocurrency Exchange and Times of India, Vikram Subburaj, CEO and Co-founder of Giottus and Naimish Sanghvi, founder, Coin Crunch India, shared their journey through a maze of regulations and the growing potential of the new age industry for avid investors.

Giottus Cryptocurrency Exchange

According to Vikram, cryptocurrency as an asset will take time to create an impact as the product is yet to mature globally. Till then, education and basic ground rules will guide investors in this journey.

“For investors, the modus operandi is similar to investing in equity. One can invest with as little as Rs.100 and even buy a fraction of crypto-based coins/tokens. Invest your money by splitting them into time periods to get a better average price given the high volatility in the markets. While meme coins like Dogecoin, Shiba Inu are popular, it is advisable to stick to the other top 10 coins and stay invested for some time. An ideal portfolio would be – 40% in Bitcoin, 40% in Ethereum (& other top 10 coins) and balance 20% in high risk coins. One should be patient for some time till the comfort level is reached to juggle around,” said Vikram.

Western institutions and large companies such as Paypal, Tesla and Microstrategy have started investing in cryptocurrencies like Bitcoin. Bitcoin’s price has risen from US$10,000-11,000 last year to around US$40,000 currently. Bitcoin and Ethereum have outperformed all traditional assets over the past 5 years.

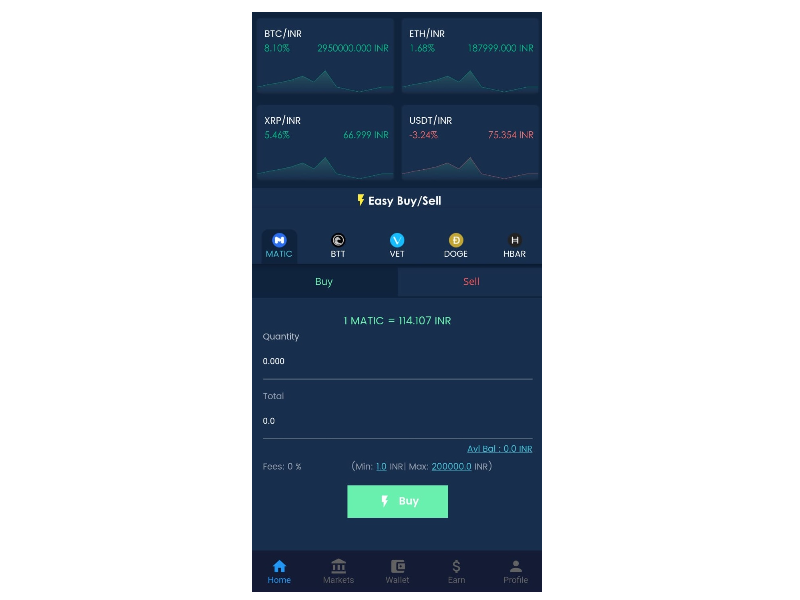

Screenshot of Giottus App showing Easy Buy process

Developed nations like US, Australia and Singapore have already issued guidelines for regulating the crypto industry. In India, it is easier to regulate than to ban it, said Vikram. There is no denying that there will be a tussle between the authorities and regulators given the decentralized nature of cryptocurrencies. RBI has recently clarified that banks are free to allow transactions with crypto entities. Indians can legally buy, sell, hold cryptocurrencies and pay tax on gains.

“As regards entry into the crypto trade, an investor can start their crypto journey with platforms like Giottus. There is a quick 5-minute registration process complying with Indian KYC regulations. After the exchange verifies the documents, within 15 minutes, investors can start trading on the platform. Invest from as little as Rs.100 on any of the 100+ cryptocurrencies the platform offers. There are no charges for depositing money into Giottus. The exchange also offers new entrants free cryptocurrency tokens to help them start off with 100% gains. To help new users, Giottus’ customer support is offered in multiple languages such as Tamil, Telugu, Bengali, Hindi and English.”, according to Vikram.

Arjun and Vikram, Co-founders of Giottus

An investor can open one account only with a single PAN card though he/she can open accounts in multiple exchanges similar to having accounts with multiple banks. Crypto trading exchanges are open 24×7 and seven days a week without a break. Hence an investor can find time outside of office hours to trade.

A word of caution for the new entrants. One should be comfortable with the price level and should put a stop loss in the cryptocurrency market if he/she is worried about the price volatility. When a price correction happens, it is probably the right time to enter, said Vikram and Naimish. Usually, investors become worried when there is a market volatility and start selling in panic while they buy when prices move up, said Vikram. “This is not ideal”, he feels.

Each cryptocurrency is unique and has real world use cases. Users must research on them before they consider buying them. For example, Ethereum, the number two cryptocurrency, is also a platform for multiple apps much like Android in the mobile world.

For novice investors, doing the right way will bring a windfall but it is ideal to start with Bitcoin and Ethereum as an SIP (systemic investment plan), according to Naimish.

On the legal front, cryptocurrency in India is still not regulated though it is legal. As new asset class is garnering the attention of global investors, it is always advisable to make small investments to start with to get a grip of the industry.

According to Vikram, it is ideal to invest in coins with good adoption as lower priced coins need not always have a compelling use case for the future. Trade is about percentage gains and not entry price of coins, he said.

For a novice investor, it is suggested to keep cryptocurrencies at 2-3 percent of overall portfolio. For an aggressive risk taker, one can go beyond 3 per cent. One can scale up the investment as the time goes by and the investor becomes familiar with the investing norms, he concluded.

Webinar Link – http://bit.ly/TOIGIOTTUS

Disclaimer: Content Produced by Times – Red Cell

from WordPress https://ift.tt/3guGyd6

via IFTTT

No comments:

Post a Comment